operating cash flow ratio industry average

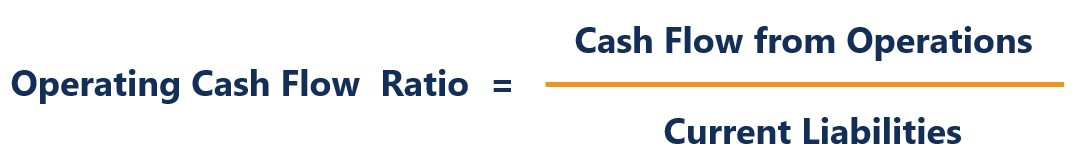

The formula to calculate the ratio is as follows. Advantages of the Operating Cash Flow Ratio.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Operating and Financial Ratios.

. This means that the automaker generates a cash flow of 5 on every 1 of assets that it has. Its especially helpful for the businesses lenders that assessability of the business to repay their dues. For a book about business ratios UCLA users can see Steven MBraggs Business Ratios and Formulas.

Sequentially TTM Free Cash Flow grew by 6601. Looking into Energy sector 3 other industries have achieved higher debt coverage ratio. High cash flow from operations ratio indicates better liquidity position of the firm.

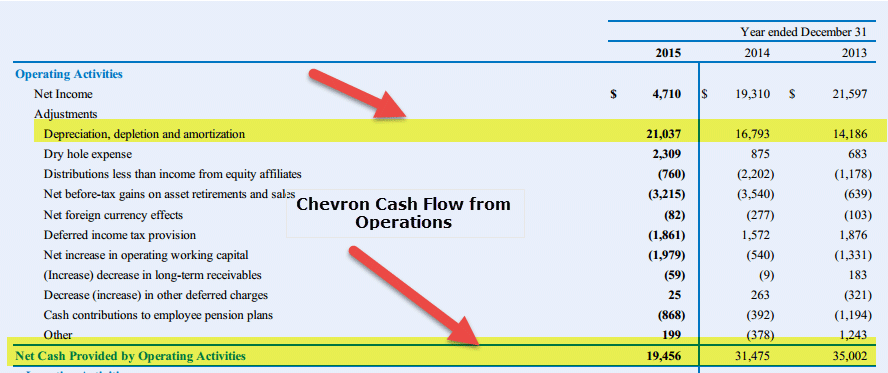

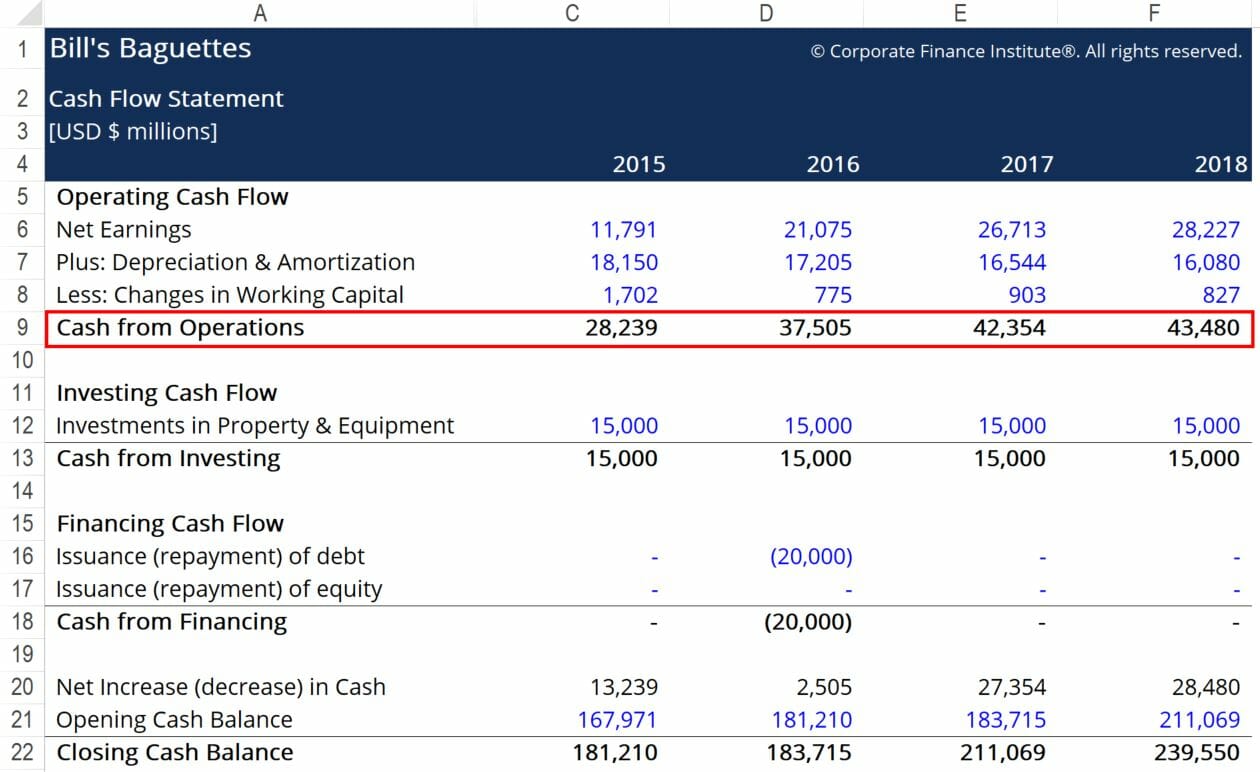

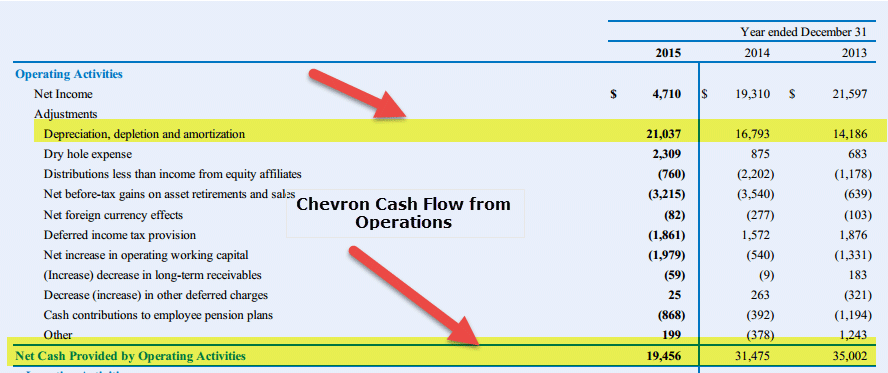

The user must understand how cash flow from operations is calculated. Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet. Alternatively the formula for cash flow from operations is.

Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. The operating cash flow refers to the cash that a company generates through its core operating activities.

Average industry financial ratios for US. A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities. 75 rows Cash Ratio - breakdown by industry.

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. Cash flow from operations can be found on a companys statement of cash flows Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. Operating cash flow ratio is generally calculated using the following formula.

18000 2000 9. Operating Cash Flow Ratio Operating Cash Flow Current Liabilities. Cash returns on assets cash flow from operations Total assets.

500000 100000. The Average Current Ratio for Retail Industry. Operating Margin Income Tax Rate Net Profit Margin Return on.

The comparison shows that the company should be generating sufficient cash flows to pay off its current liabilities. So a ratio of 1 above is within the desirable range. This results in an operating cash flow ratio of 167.

The operating cash flow ratio is a measure of a companys liquidity. Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio. All Industries Measure of center.

Price to Cash flow ratio for the Retail Apparel Industry Retail Apparel Industrys current Price to Cash flow ratio has decreased due to shareprice contraction of -1656 from beginning of the forth quarter and due to the sequtial cash flow for the trailig twelve month period contraction of -1422 to Pcf of 1242 from average the Price to Cash flow ratio in the third quarter of 1668. It reveals a companys ability to meet its. Industry Ratios included in Value Line.

Price Earnings Price Book Net Profit Margin Price to Free Cash Flow Return on Equity Total Debt Equity and Dividend Yield. Cash Returns on Asset Ratio 5. During the past 3 years the average Operating Cash Flow per Share Growth Rate was 1830 per.

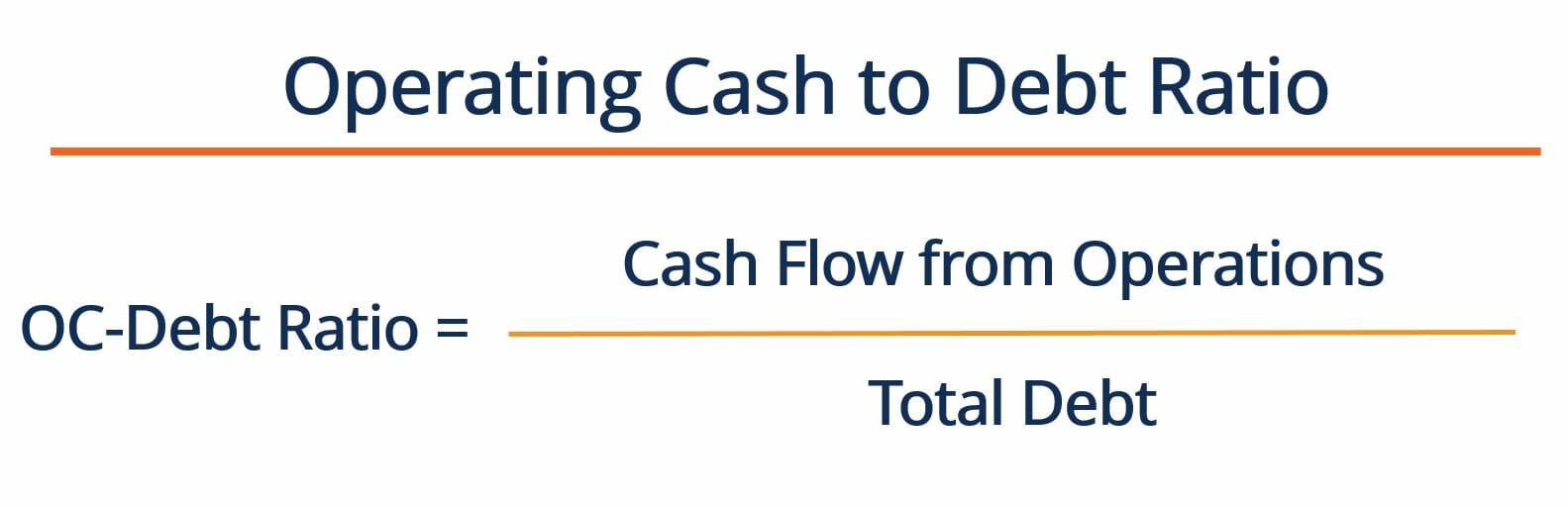

Industry Comparisons 2017 Industry Average Current 27X Quick 10X Inventory turnover 61X. Targets operating cash flow ratio works out to. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt.

On the trailing twelve months basis total debt decreased faster than Industrys ebitda this led to improvement in Industrys Debt Coverage Ratio to 288 above Oil And Gas Production Industry average Debt Coverage Ratio. This ratio is calculated by dividing operating cash flow a figure that can be obtained from a companys cash flow statement by total debt obligations. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow.

Retail is an industry that is expected to generate cash on a day-to-day basis and its easy for lenders to get. Median recommended average Financial ratio. Its balance sheet as of the end of that period shows current liabilities of 1500000.

Cash ratio is a refinement of quick ratio and. 220 rows An acceptable current ratio aligns with that of the industry average or might be slightly higher than that. Cash Flow from Operations refers to the cash flow that the business generates through its operating activities.

In 2014 Times Interest Earned was. The operating cash flow ratio is not the same as the operating cash flow margin or the net income margin which includes transactions that did not involve actual transfers of money depreciation is common example. Net cash flow from operating activities comes from the statement of cash flows and average current liabilities comes from the balance sheet.

This compares to 14 for those industries with the largest cash balances at 20-40 of sales. Debt Coverage Ratio total ranking has. Total Capital Return on Shareholder Equity Retained Earnings to Common Equity All Dividends to Net Profit Average Annual Price to Earnings Ratio Relative Price to Earnings Ratio Average Annual Dividend Yield.

The current ratio is an essential financial matric that helps to understand the liquidity structure of the business. 75 rows Cash Ratio - breakdown by industry. Debt Coverage Ratio Comment.

If the ratio is less than 10 then the firm is suffering a liquidity crisis and is in danger of. This number can be found on a companys cash flow. The Times Interest Earned Ratio is.

This corresponds to a value of 1 or little higher than 1. Meaning the interest of The Learning Company was covered 9 times. Value Investment Funds Two 12 Year Running Average Annual Return After Quarterly.

Comparing it with other automakers in the economy an investor can identify how are the growth prospects of the firm. Operating cash flow ratio is generally calculated using the following formula. The formula for calculating the operating cash flow ratio is as follows.

Operating cash flow ratio measures the adequacy of a companys cash generated from operating activities to pay its current liabilitiesIt is calculated by dividing the cash flow from operations by the companys current liabilities. High Low Operating Cash Flow Ratio.

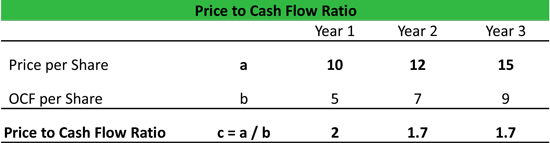

Price To Cash Flow Formula Example Calculate P Cf Ratio

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

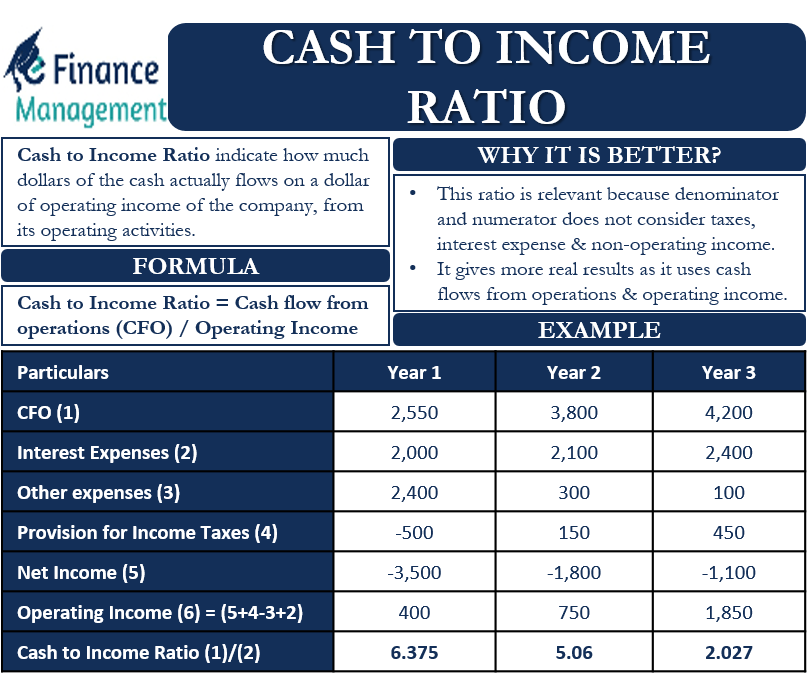

Cash To Income Ratio Meaning Formula Example And More

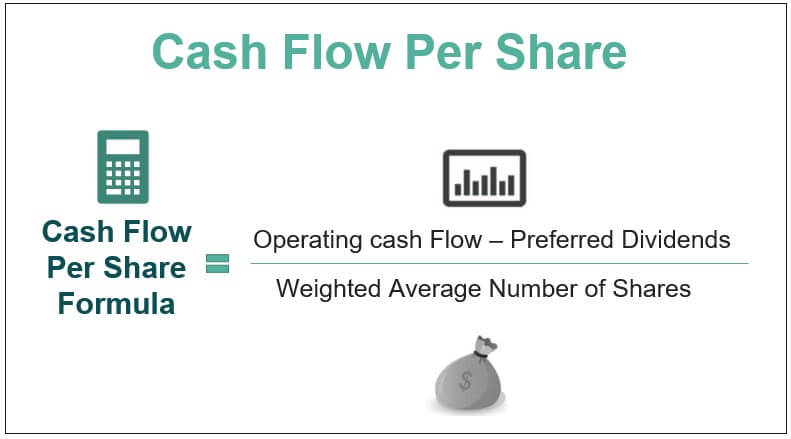

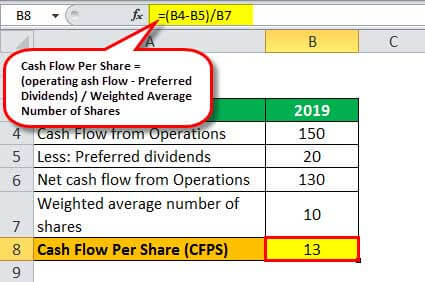

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Ratio Formula Example Calculation Analysis

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow Per Share Formula Example How To Calculate

Using The Price To Cash Flow To Find Value Screen Of The Week Nasdaq

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Price To Cash Flow Formula Example Calculate P Cf Ratio

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)