restaurant food tax in pa

LicenseSuite is the fastest and easiest way to get your Pennsylvania meals tax restaurant tax. 7272 states that the department or any of its authorized agents are authorized to examine the books papers and records of any taxpayer in order to verify the accuracy and.

Taxes On Food And Groceries Community Tax

Compare purchase orders to revenue.

. What is lower rate of tax for food and health. Please note that the sample list below is for illustration purposes only and may contain licenses. PA law states that sales tax will be imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the.

While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. What is the tax on restaurant food in Philadelphia. Below are examples of how Pennsylvania sales tax applies to third-party delivery businesses.

Resources Blog Food. Pennsylvania has a 6 statewide sales tax rate but. If three months worth of purchase orders are.

V D department store a nonfood retailer operates a restaurant located on its premises. Examples of dealers are delis restaurants and grocery stores as well as hospitals schools nonprofit groups and. A restaurant contracts with a delivery business to list.

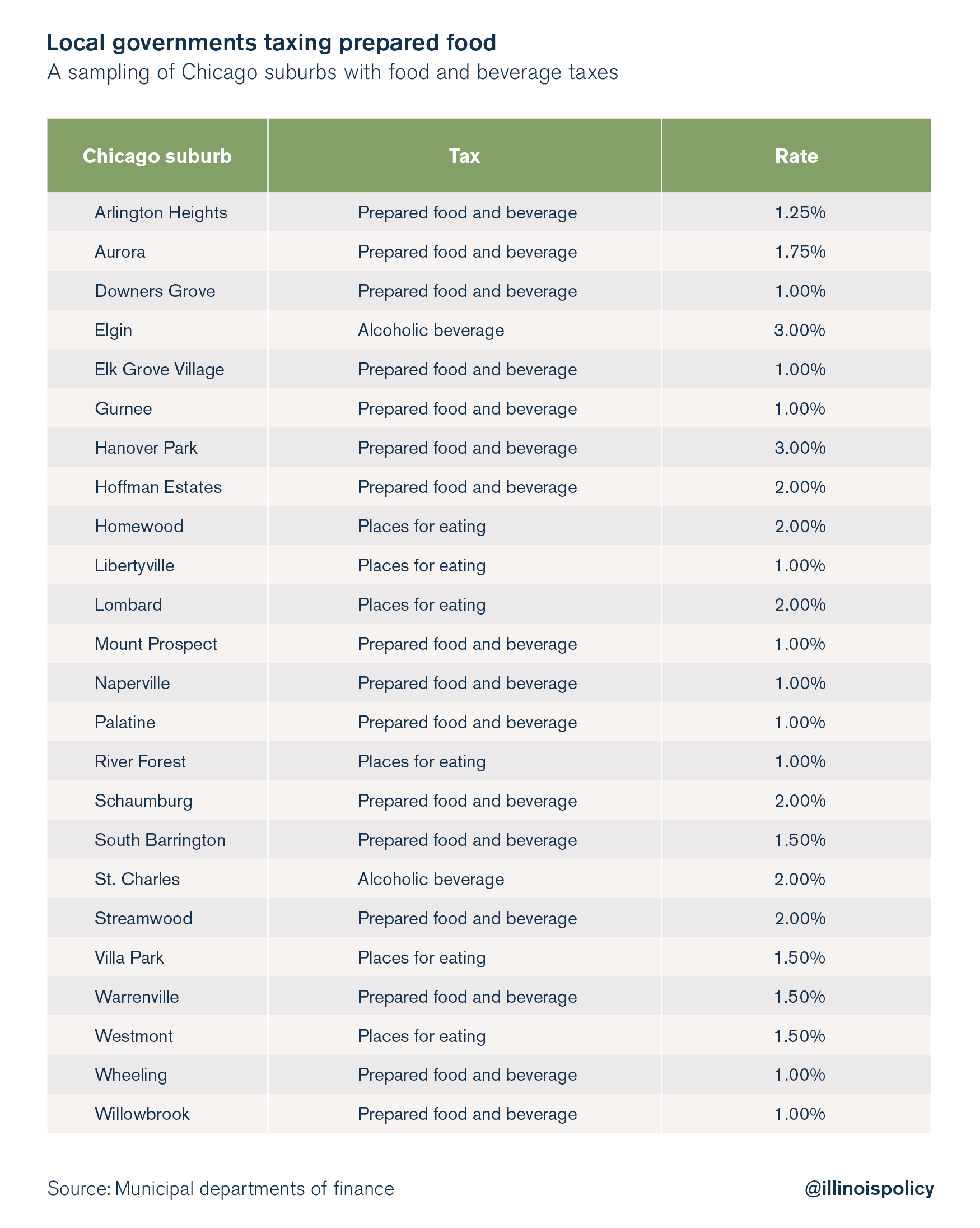

As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the. TAX DAY IS APRIL 17th. Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales.

Start filing your tax return now. If whiskey costs 5 per shot each bottle should generate 85100 in revenue. Retail food facilities are governed by Title 3 of the Consolidated Statutes Chapter 57 - Food Protection 3 CSA.

Burger coupon by the restaurant along with the description of the item and coupon on the register receipt establishes a new taxable purchase price of 3 which is subject to 12 cents in tax. Restaurant owners not corporations may qualify for an additional 20 deduction on their business net income for the year. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

By Jennifer Dunn August 24 2020. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is.

Chicago Restaurant Tax. This page describes the taxability of. Get a Food Establishment Retail Non-Permanent Location License.

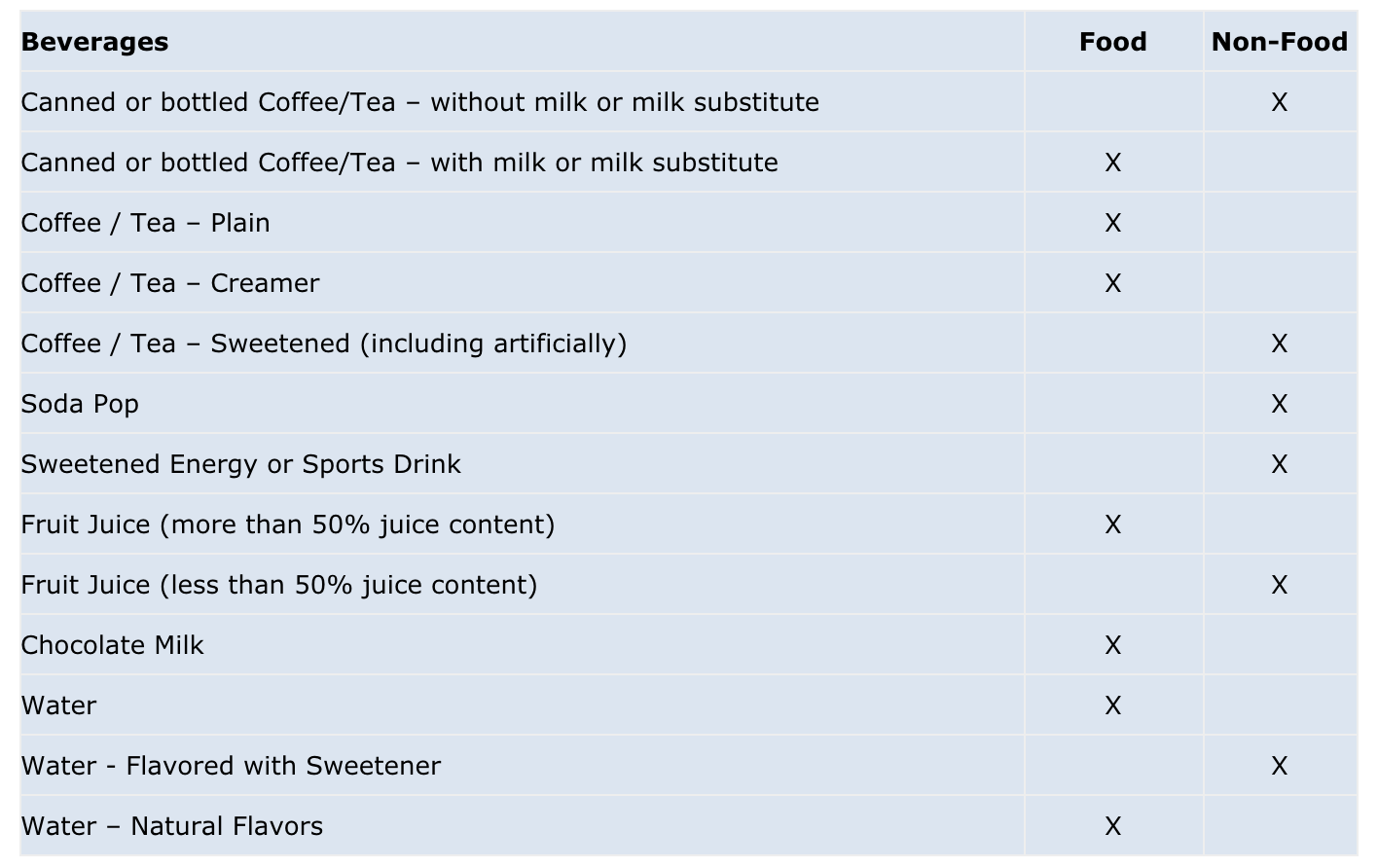

You may be able to take the qualified business. In the US each state makes their own rules and laws about what products are. Pennsylvania grocery items are tax exempt and in Pennsylvania this includes candy and gum but not alcohol.

Is food taxable in Pennsylvania. Exemptions to the Pennsylvania sales tax will vary by state. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on.

All Retail Food Facilities are regulated by The Food Code. The restaurant menu includes appetizers salads entrees side dishes desserts and beverages.

Exemptions From The Pennsylvania Sales Tax

2022 Nurse Appreciation Week Menu Red Robin

Illinois Sales Tax Audit Basics For Restaurants Bars

How To Get Restaurant Licenses And Permits And What They Cost

Is Food Taxable In Pennsylvania Taxjar

California Sales Tax Basics For Restaurants Bars

Hellertown Lower Saucon Restaurant Week Begins Sunday Jan 17

Greensburg Restaurant Week Home Facebook

Sales Taxes In The United States Wikipedia

Philadelphia Pennsylvania 1940s Postcard Sansom House Sea Food Restaurant Ebay

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

Villagio Pizza Restaurant Menu In Philadelphia Pennsylvania Usa

Nick S Pizza Restaurant Page 3 Italian Food Pizza In Bethlehem Pa

Rizzo S Malabar Inn Crabtree Pa Stuffed Shells Drive Thru Special Thursday 7 23 Starts At 3 30 Facebook

Chicago Suburbs Eye New Dining Alcohol Taxes

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Is Food Taxable In Ohio Taxjar

Estia Greek Restaurant Greek Mediterranean Cuisine Philadelphia Pa 19102